Previous Post

Securing the Future: A Comprehensive Guide to Life Insurance

Posted on May 2, 2024 by Charlie Marlow

May 2nd is National Life Insurance Day and is a great time to review our life insurance needs and buy or adjust our policies as needed so that our loved ones are cared for in the case of death.

Insurance is a defensive tool in our financial arsenal as it protects us from financial loss. Life insurance protects our loved ones from the loss of income due to the death of the insured. Life insurance proceeds can be used to cover medical expenses, funeral costs, remaining debts, mortgage payments, tuition, and other living expenses, relieving the burden on dependents.

How much life insurance do you need? While the amount needed is dependent on the needs of the family based on your unique situations and will change over time, there are two methods available to help you determine the right amount for you and your family.

The first method is the income replacement method which is determined based on the income of the insured. Many financial advisors will tell you that you need at least 10 to 12 times your income in life insurance. This allows the proceeds to be invested and then the earnings will replace the deceased’s income.

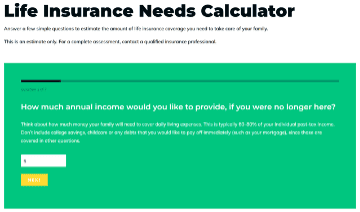

The second method is known as the Needs Based Approach and takes your unique life situation and helps you compute the amount of coverage you need based on income needed, for how long that income will be needed, debt to pay off immediately, childcare expenses, school and college expenses, other anticipated expenses, as well investments and savings currently held, other insurances, and government assistance available. A good online calculator may be found at LifeHappens.Org.

Once you’ve determined your need for insurance coverage, you must determine the type of insurance you want to buy. While packaged under different names, there are basically two types of life insurance: term and whole life.

Term insurance is typically your best insurance purchase as it is pure insurance where you pay a fixed premium amount for a fixed period (term) for a set death benefit to be paid upon the death of the policyholder. If the policyholder dies during the term the beneficiary is given the amount of the death benefit, if the policyholder is still living at the end of the term the policy lapses.

Some types of term insurance work differently. Some will remain in force but the premium and/or the death benefit will change. Decreasing term insurance offers a death benefit that decreases as you age. This can be a good purchase to keep the premiums low by providing a smaller death benefit as you age. As children grow and move out of the house, less is needed for their care and education. As you save and invest over your lifetime, you may not need as much death benefit to meet the needs of your survivors.

Another type of term insurance is increasing term insurance which increases the death benefit over the life of the policy. This allows for increased coverage for a growing family or expenses over time without having to apply for and purchase a new policy.

Some term policies may stay in force as long as you pay the premium, but the premium increases based on age brackets such as five-year increments.

The other major category of life insurance is whole life insurance, so named as it is designed to cover a policyholder for their entire lives, with premiums that last their entire lives. Whole-life policies usually include a savings or investment component to the policy that allows the policyholder over time to grow a cash value in the policy that can be borrowed against or cashed out if the policy is canceled. Premiums for whole-life policies are typically higher than term policies for the same coverage in order to save and invest for the policyholder. Some whole-life policies will waive future premiums once the policy’s cash value’s earnings have grown to a point sufficient to cover the cost of the premium.

Military members have the same need for life insurance as the general population. If someone is dependent on you for your income, then you probably need some level of life insurance. All military members can purchase up to $500,000 life insurance through the Serviceman’s Group Life Insurance (SGLI) program in increments of $50,000 at the monthly cost of $3 per $50,000 (six cents per $1,000) coverage regardless of age or military specialty. Learn more about SGLI here.

For an additional $1 per month the servicemembers with SGLI can purchase Traumatic Injury Protection coverage that covers payments for loss of sight, limbs, speech, and paralysis due to traumatic injury. Visit VA.gov to learn more about the benefits of this program.

Military members may also obtain life insurance on their civilian spouse and children through the Family Servicemember’s Group Life Insurance (FSGLI) program. Members who are covered under SGLI can purchase up to $100,000 in coverage for their spouse and $10,000 for dependent children. Premiums are based on the age of the spouse and amount of coverage. There is no charge for coverage of dependent children. Spousal coverage may be converted to a permanent individual policy upon the member’s separation from the military, divorce, election to end SGLI or FSGLI, or member’s death. See premium amounts and other details at FSGLI.

A lesser-known benefit of military service is the death gratuity, a tax-free payment of $100,000 to eligible survivors of someone who dies while on active duty or while serving in certain reserve statuses. The payment amount does not change depending on the cause of death. Learn more about this benefit at the DoD Military Compensation website Death Gratuity and the DoD Financial Management Regulation Vol 7A Chapter 36. While this is not technically insurance, military members should consider this when determining their insurance needs.

Many commercial insurance companies also insure military members but members should be careful to note if the policies have a War Exclusion Clause that prevents death benefits if the death is related to war or similar activities or from participating in aviation or parachuting duties. Because of the dangerous nature of the military, this may be a concern for members looking for additional life insurance. Many military-friendly insurers do not have such exclusions.

Military members may continue their SGLI after separation or retirement through the Veterans’’ Group Life Insurance (VGLI) program. Coverage is available from $10,000 to $500,000. Initial coverage is limited to the amount you had while on SGLI but can be increased by $25,000 every five years (to a maximum of $500,000) until you reach 60 years of age. If you sign up for VGLI within 240 days of leaving the military, you do not have to prove that you are in good health. This is a great benefit for those who may not qualify for commercial insurance. You can apply for VGLI for up to 1 year and 120 days after leaving the military, but after the 240-day mark, you will have to provide proof of health. Learn more at VGLI.

Although not technically an insurance plan, the Survivor Benefit Plan allows a military retiree to provide a continuous lifetime annuity of 55% of the deceased retiree’s pay for their surviving dependents. Premiums are deducted from the retiree’s pay before taxes effectively reducing taxes and taxable income. The survivor’s benefit is adjusted for inflation and is a taxable benefit. See the DoD Military Compensation’s Survivor Benefit Program site for more information.

While we don’t like to think about life insurance, it should be a vital part of your financial plan. Life insurance is a loving way of taking care of your family after your death.

Explore More with My Military Lifestyle and Finances!

Next Post