Previous Post

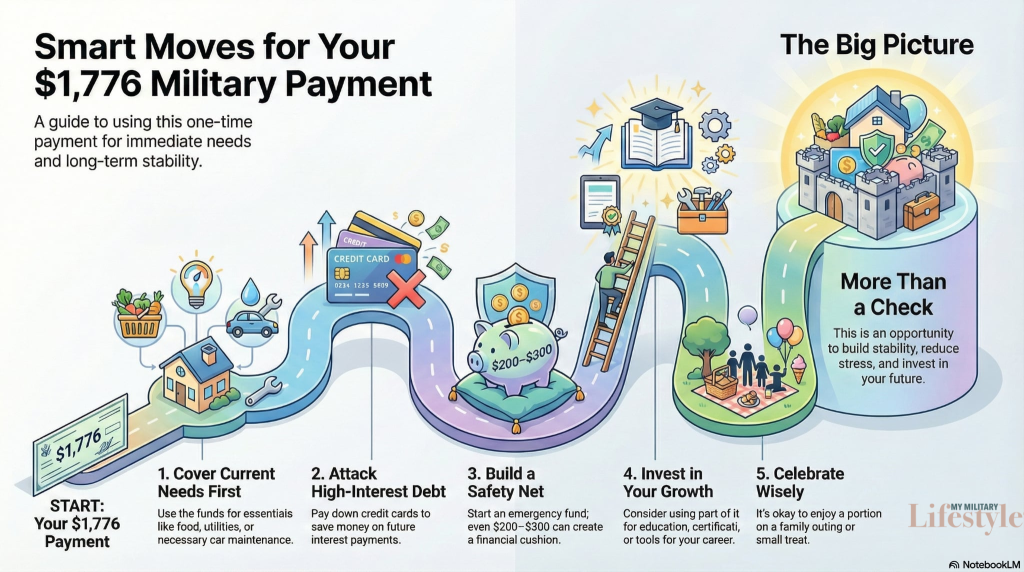

Making the Most of Your $1,776 Warrior Dividend

Posted on December 23, 2025 by Charlie Marlow

The President announced the $1,776 Warrior Dividend, and DFAS has begun processing payments for active-duty members and some reservists in grades O-6 and below. The dividend is not taxable and should appear on the BAH line of your Leave and Earnings Statement.

Quick mindset: Pause, Plan, Prioritize

A one-time payment can feel like a windfall. Before you spend, take a moment to decide what will help you most now and later. Ask yourself: Does this purchase match my values and goals? Will this choice support my family’s stability?

Practical steps to Consider:

- Cover Immediate Needs:

- Pay essentials such as groceries, utilities, or transportation.

- Handle overdue or necessary expenses like car maintenance or medical bills to avoid higher costs later.

- Build or Top Up an Emergency Fund:

- Aim for three to six months of expenses over time but start small.

- Set aside part of the payment into a savings account; even $200–$300 creates a useful cushion.

- Reduce High-interest Debt:

- Apply funds to credit cards or other high-rate loans.

- Every dollar toward debt reduces future interest and frees up monthly cash flow.

- Invest in Your Career and Skills:

- Using some money for education, certifications, or tools that improve job prospects or civilian transition options can be a great use of the funds.

- Save for Longer-term Goals:

- After covering needs and reducing debt, consider allocating money toward a vehicle, a home down payment, or retirement savings.

- Celebrate Responsibly:

- It’s okay to enjoy a portion of the money. Plan a modest family outing or a small treat.

- Balance enjoyment with financial responsibility so the benefit lasts.

Here’s a simple allocation example as a guide

- Essentials / overdue bills: 30%

- Emergency savings: 25%

- Debt repayment: 25%

- Career/education: 10%

- Fun / family: 10%

Adjust percentages to fit your situation and priorities.

Takeaway

This $1,776 is more than a one-time check; it’s an opportunity to build stability, reduce stress, and invest in your family’s future. A little planning now can make a big difference down the road.

Explore More with My Military Lifestyle and Finances!

Next Post

Written by

More Military Life Posts