Previous Post

It’s an Emergency! Should I Borrow From My TSP or 401(k)?

Posted on September 11, 2025 by Charlie Marlow

Financial emergencies happen. Borrowing from your Thrift Savings Plan (TSP) or 401(k) can be a lifeline in a financial pinch, but it’s not a decision to take lightly. Borrowing from your 401(k) or Thrift Savings Plan (TSP) is one of those financial moves that can feel deceptively simple; after all, you’re “just borrowing from yourself”, but the ripple effects can be long-lasting. Let’s walk through the steps in a way that’s clear, structured, and practical so you can make a fully informed decision.

Advantages of Borrowing from TSP or 401(k):

- No Credit Check: You’re borrowing from yourself, so your credit score isn’t impacted.

- Lower Interest Rates: Usually lower than personal loans or credit cards, and the interest you pay goes back into your account.

- Avoid Taxes and Penalties: Unlike early withdrawals, loans aren’t taxed if repaid on time.

- Quick Access to Funds: No lengthy approval process; funds are usually available within days.

- Continued Contributions: You can often keep contributing to your retirement while repaying the loan.

Disadvantages and Risks:

- Opportunity Cost – Money you borrow is no longer invested, so you miss potential market growth.

- Repayment Risk – If you leave your job, the outstanding balance may be due quickly (often within 60–90 days).

- Double Taxation – You repay with after-tax dollars, and you’ll be taxed again when you withdraw in retirement.

- Reduced Retirement Cushion – Even if repaid, you may fall behind on your long-term savings goals.

- Default Consequences – If you can’t repay, the loan becomes a taxable distribution, plus a 10% penalty if you’re under 59½.

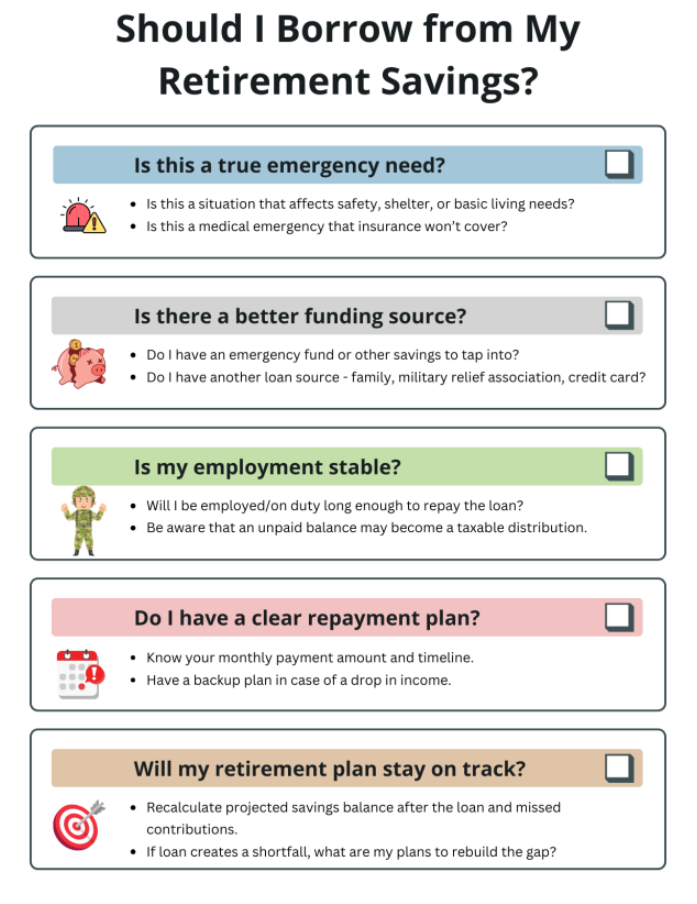

Key Considerations Before Borrowing

- Purpose of the Loan: Is it for a true emergency or a discretionary expense? Retirement funds should be a last resort.

- Other Options: Have you explored emergency savings, personal loans, or even 0% APR credit cards first?

- Job Stability: If you’re considering a career change or retirement soon, repayment terms could get tricky.

- Tax Implications: Especially if you’re juggling Roth vs. Traditional accounts—each has different rules.

- Long-term Impact: Will this loan derail your retirement timeline or reduce your future financial security?

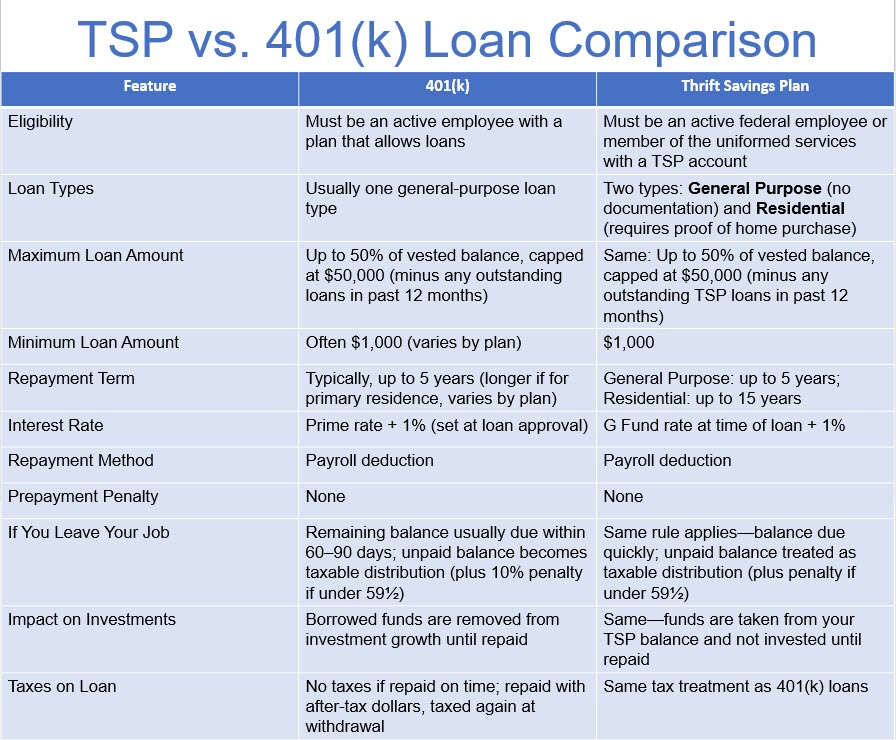

Here’s a clear, side-by-side comparison of 401(k) and TSP loans comparing loan provisions of TSP and 401(k):

Key Takeaways:

- TSP and 401 (k) Rules: They are similar, but TSP loans have a clearly defined Residential option with up to 15 years to repay.

- Interest Rates Charged Differ: TSP uses the G Fund rate + 1%, which is often lower than prime + 1% for 401(k)s.

- Job Stability Matters: Leaving your job can trigger immediate repayment for both.

- Opportunity Cost Is Real: Money borrowed is out of the market, so you lose potential growth.

Additional Resources:

- Thrift Savings Plan

- 401(k) – Rules vary by employer and plan. Check with your Human Resources office or 401(k) plan custodian for details.

Explore More with My Military Lifestyle and Finance!

Next Post

Written by

More Military Life Posts