Military Pay and Entitlements – Basic Pay

Basic Pay

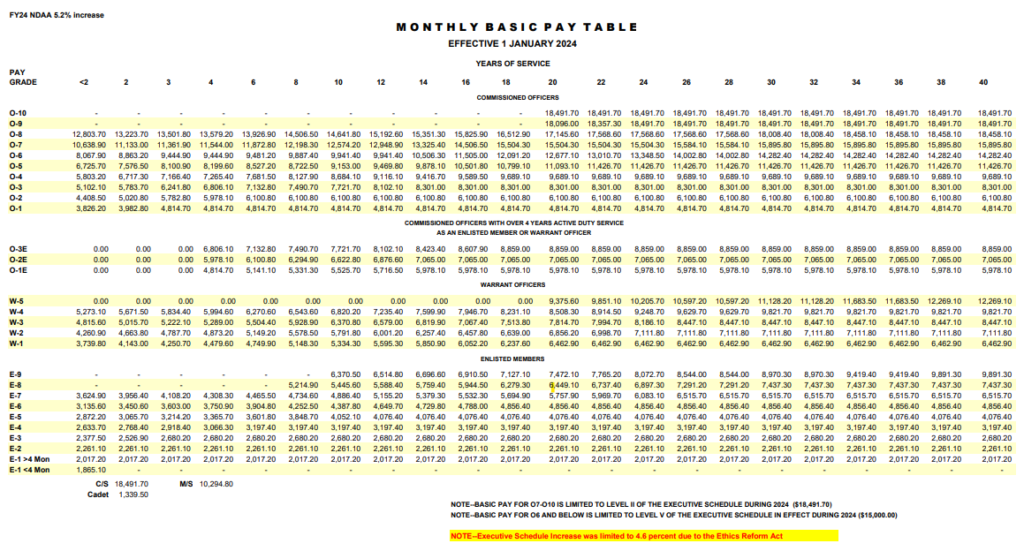

Every member in the military is entitled to basic pay, or base pay, as it is often called. Chapter 1 of the DODFMR Volume 7A, Chapter 1 covers the entitlement of basic pay. This entitlement is the equivalent to a civilian salary and is determined by a member’s pay grade, the date entered service, and the years of service. Basic pay rates typically increase for time in service with rates established for 2 years or less, and over 2, over 3, over 4, and for each additional 2-year period through over 30 years. These are referred to as longevity increases. Not every pay amount increases in each two-year period. For example, an E1 will receive one amount for the first four months with an increase in the fifth month and both an E1 and E2 have no increase for longevity. Other grades have no longevity increases after the over 4 or over 6-year marks.

To read a basic pay chart you find the grade in the left-hand column and then the longevity period across the top, and the intersection of the two is the basic pay for that grade/longevity combination.

Photo Credit: U.S. Dept. of Defense

Except for the month of entry into service and month of discharge, basic pay is considered a 30-day entitlement regardless of the number of days in the month. Basic pay is the same for the 28 or 29 days of February as it is for the 31 days in March.

Basic pay is taxable and subject to federal and state income taxes as applicable based on the member’s state of residence unless earned while serving in a tax exclusion zone. Basic pay is also subject to FICA (Social Security and Medicare) withholding and is withheld even if the member is serving in a tax exclusion zone.

Members are entitled to basic pay for the entire period of service with a few exceptions such as unauthorized absence, court-martial, civil confinement, or forfeiture due to non-judicial punishment.

Military Pay & Entitlements Series

1. Introduction

2. Basic Pay

3. Basic Allowance for Subsistence (BAS) – Food Allowance

4. Basic Allowance for Quarters (BAH) – Housing Allowance

5. Common Deductions

6. How to Read Your Leave and Earnings Statement (LES)

7. Uniform and Clothing Allowances

8. Cost of Living Allowance (COLA)

9. Special and Incentive Pays

10. Additional Special and Incentive Pays

11. Overseas or Station Allowance

12. PCS and Travel

13. Special Situations

Military Pay & Entitlements Series – Printable Version of the Whole Series

Explore More with My Military Lifestyle and Finances!

Feel free to leave any questions you may have regarding any of the topics and I’ll be happy to answer or point you towards an answer. Don’t be shy about asking, this can be a confusing topic and if you’re thinking the question, so is someone else!