Previous Post

Debt Reduction

Posted on March 22, 2025 by Charlie Marlow

Eliminating debt frees up money used for payments and saves interest. Doing so frees up funds for saving, investing, and lifestyle.

Where to start:

- Your local installation has financial counselors available to help you manage and eliminate your debts! Additionally, Military OneSource also offers FREE financial counseling for military families.

- Planning and saving for future purchases can reduce or eliminate the need for future debt, allowing you to avoid monthly payments and interest costs.

- Two popular and proven debt elimination techniques are the debt snowball and the debt avalanche methods.

Debt Elimination Techniques:

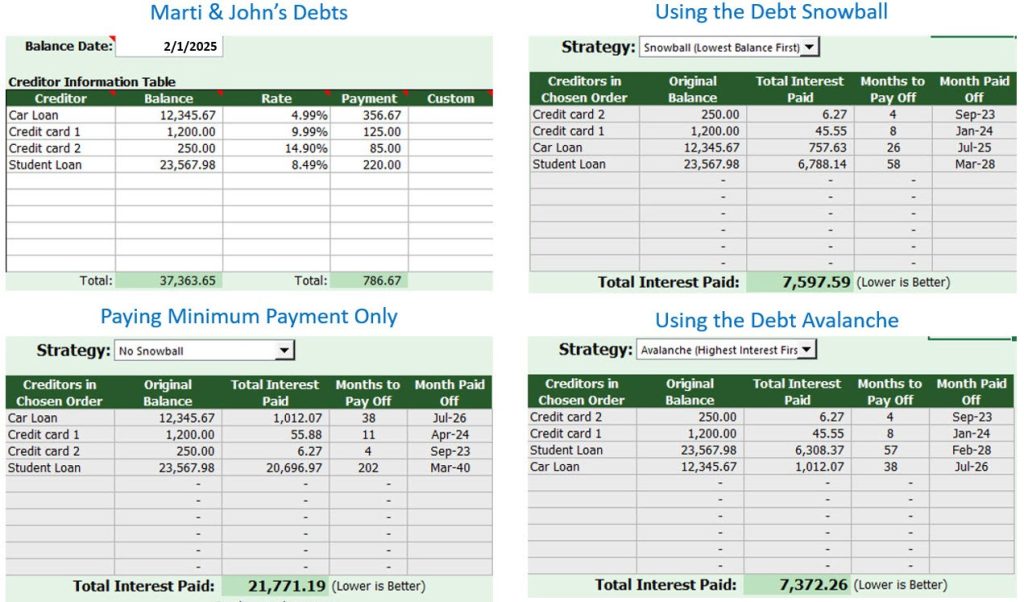

- The Debt Snowball method is paying off your smallest debts first without regard to the interest rate. Make the minimum payment on every debt except the one with the smallest balance. Pay as much as you can on that debt, then when it is paid off, roll that amount onto the amount you were paying on the next smallest debt, and so on until you eliminate all of your debt. This method is effective because it gives you quick victory over the small debts, encouraging you to get them all paid. This method works best for multiple debts.

- The Debt Avalanche method of debt elimination is similar to the debt snowball, except you focus on the debt with the highest interest rate first, paying as much on that one as you can while making the minimum payments on any other debts. Once the debt with the highest rate is paid, you roll that same amount on payment onto the debt with the next highest rate. This method will allow you to pay off your debt with the least amount of interest being paid and tends to work best when you have fewer loans or are very disciplined.

You can discover your “I’m debt free!” date by using the free PowerPay tool available at PowerPay: Debt Reduction Tool | USU or the Excel debt elimination calculator.

Explore More with My Military Lifestyle and Finances!

Next Post

Written by

More Military Life Posts

Time to Prep for your Military Brat’s Senior Year: Road to Graduation

Summer’s coming to an end and the kids are headed back to school. For those...